The real estate market is a dynamic entity that constantly responds to various economic factors. Among the many influences on this market, mortgage rates have traditionally played a significant role. Typically, when mortgage rates rise, buyer activity tends to decline as affordability decreases. However, in an unexpected turn of events, recent trends have shown that buyer activity is on the rise, even in the face of high mortgage rates. This phenomenon highlights the resilience of the real estate market and suggests that other factors are at play. In this blog post, we will delve into the reasons behind this surprising surge in buyer activity.

One of the key factors contributing to the buoyancy of the real estate market amidst high mortgage rates is a shift in buyer motivations. Buyers are now compelled by various external factors that outweigh the impact of rising interest rates. These motivations include favorable job prospects, the desire for larger living spaces, changing demographics, and the ongoing pandemic’s influence on housing preferences.

Job Prospects

A strong job market and improving economic conditions can provide buyers with the confidence and financial stability to pursue homeownership, even in the face of higher mortgage rates. As job opportunities increase and wages improve, buyers are willing to navigate the challenges posed by increased borrowing costs.

Desire for Larger Living Spaces: The COVID-19 pandemic has reshaped our relationship with our homes. With remote work becoming more prevalent, buyers are seeking larger living spaces that accommodate work-from-home setups, home offices, and flexible living arrangements. The need for more room and enhanced comfort has outweighed the impact of higher mortgage rates for many potential buyers.

Changing Demographics: The real estate market is witnessing a shift in demographics as millennials and Gen Z individuals enter the homebuying stage of their lives. These younger generations value homeownership and are eager to establish roots, irrespective of temporary increases in mortgage rates. Their entry into the market helps counterbalance any decline in demand caused by rising rates.

Pandemic Influence: The pandemic has prompted individuals to reassess their living situations, leading to increased demand for suburban and rural properties. The desire for more space, a connection with nature, and a desire to move away from densely populated urban areas have propelled buyer activity in these regions, mitigating the impact of higher mortgage rates.

Limited Supply

Another crucial factor contributing to the sustained buyer activity is the persistent shortage of housing supply. For several years, the real estate market has grappled with an imbalance between supply and demand. The limited availability of homes has created a competitive environment, where buyers are willing to absorb higher mortgage rates to secure their desired properties. In this scenario, the urgency to buy outweighs the potential drawbacks of increased borrowing costs.

Low Inventory: Limited inventory levels create a sense of urgency among buyers, as they fear missing out on suitable properties. This urgency often trumps concerns about high mortgage rates, as buyers prioritize acquiring a home over temporary fluctuations in interest rates.

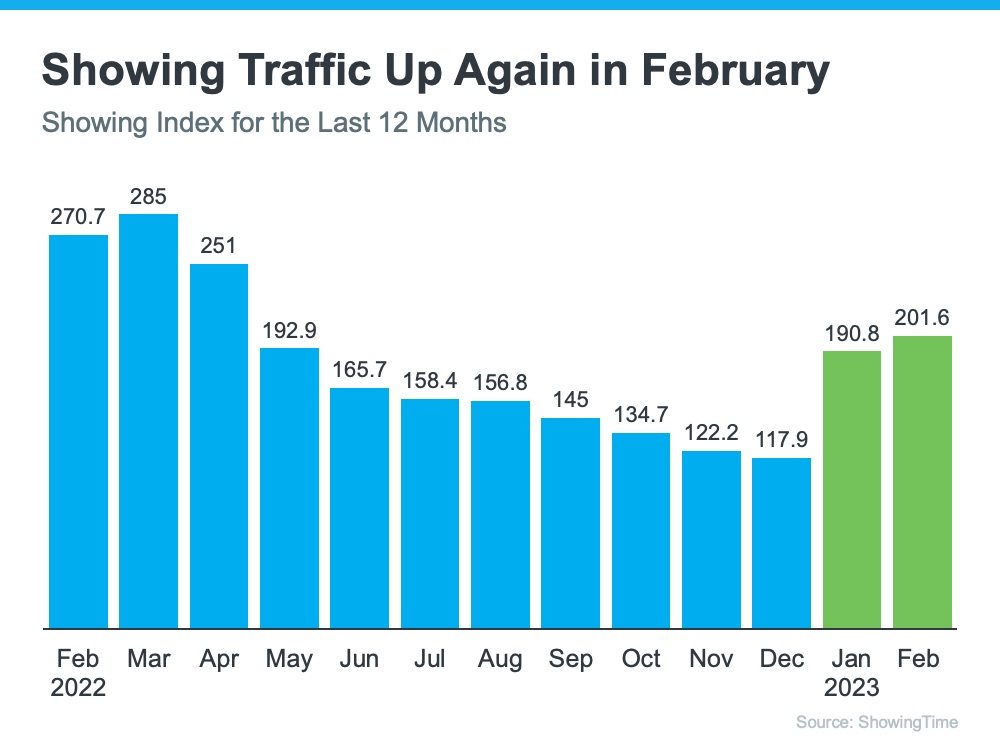

Data from the latest ShowingTime Showing Index, which is a measure of buyers actively touring homes, helps paint the picture of how much buyer demand has increased in recent months (see graph below):

As the graph shows, the first two months of 2023 saw a noticeable increase in buyer traffic. That’s likely because the limited number of homes for sale kept shoppers looking for homes even during colder months.

Seller’s Market: The current real estate landscape is predominantly a seller’s market, where demand outstrips supply. In such market conditions, buyers face increased competition, leading to bidding wars and quick decision-making. These factors can drive buyer activity and overshadow the impact of higher mortgage rates.

Jeff Tucker, Senior Economist at Zillow, says the increased buyer activity could continue:

“More buyers will keep coming out of the woodwork. We always see a seasonal uptick in home shoppers in March and April . . .”

If you’re looking to sell your house, seeing buyers still active in the market this year should be encouraging. It’s a sign buyers are out there and could be looking for a home just like yours. Working with a real estate professional to list your house now will help you get your home in front of eager buyers today.

Despite the historically significant influence of mortgage rates on buyer activity in the real estate market, recent trends have defied expectations. The resilience of buyer activity, even in the face of high mortgage rates, highlights the interplay of various other factors. The shift in buyer motivations, the scarcity of housing supply, and changing market dynamics have all contributed to the sustained demand for real estate. These factors, combined with a strong job market and evolving housing preferences, have fostered an environment where buyers are willing to overcome the challenges posed by higher mortgage rates.

While it’s important to acknowledge that high mortgage rates can impact affordability and deter some potential buyers, the current market demonstrates that buyers are adaptable and resourceful. They are willing to adjust their expectations, explore alternative financing options, and prioritize long-term goals over short-term fluctuations in interest rates.

Furthermore, the real estate market has historically experienced cycles of fluctuating mortgage rates, and buyers have learned to navigate these cycles. They understand that mortgage rates can change over time and that locking in a rate now may still be favorable in the long run.

In addition to the factors discussed above, government initiatives and policies can also play a role in sustaining buyer activity despite high mortgage rates. For example, if there are incentives such as tax credits or down payment assistance programs, buyers may find it more financially feasible to enter the market even when rates are high.

It’s worth noting that the real estate market is not immune to the influence of mortgage rates. If rates continue to rise significantly, there may come a point where buyer activity begins to decline. However, the current trend suggests that other market dynamics and buyer motivations are strong enough to counterbalance the impact of high rates.

As the real estate market continues to evolve, it’s crucial for buyers to remain informed and work closely with knowledgeable real estate professionals. Mortgage brokers and financial advisors can provide valuable insights and guidance, helping buyers navigate the intricacies of the market and make informed decisions based on their individual circumstances.

In conclusion, the surge in buyer activity despite high mortgage rates is a testament to the resilience and adaptability of the real estate market. Shifting buyer motivations, limited housing supply, and evolving market dynamics have all contributed to sustained demand. While mortgage rates remain an important factor in the home buying process, buyers are demonstrating their ability to overcome these challenges and pursue their homeownership goals. By staying informed and working with industry professionals, buyers can make sound decisions that align with their long-term financial objectives.